This brief article helps to clear up a common misconception about Bitcoin. Bitcoin is frequently portrayed as the chosen currency of crooks. There is no doubt that criminal activity has been associated with the Bitcoin ecosystem, but I would argue that cash is still king in the underworld. Jason Bloomberg writes in his recent Forbes article [1]: “Professional criminals’ number one requirement is a secure, anonymous way to move and store money, and Bitcoin fits the bill perfectly.” There’s a really big problem with that statement: it is simply and provably not true. It displays ignorance in how Bitcoin really works. In fact, Bitcoin is a potential nightmare for criminals. If they want to minimize getting caught, they’ll stick with cash and the legacy banking system, but more on that later. Many people mindlessly repeat the meme that Bitcoin is anonymous, and therefore conclude it must be the ideal currency of criminals. But is this really true? Don’t forget, every transaction that occurs in Bitcoin is recorded in the blockchain—the ledger is completely transparent. The history of every Bitcoin transaction is publicly accessible. These statements bear repeating. Every Bitcoin transaction is cemented in the blockchain, which can be examined and analyzed at will by anyone with minimal technical know-how.

Why do so many people claim that Bitcoin is anonymous? From a computer science perspective, Bitcoin is only pseudonymous, which is a fine but important line short of anonymous. What’s the difference, and why is this so vitally important to understand?

We have to examine a few technical details here, and they’ll be simplified for the sake of clarity. Your name, or the name of whom you’re sending bitcoins to, is not recorded on the blockchain. Instead, the blockchain uses Bitcoin addresses to record transactions. Bitcoin users can create new addresses any time and do not directly reveal their identity. However, from a computer science perspective, these addresses are only pseudonymous and not truly anonymous. What’s the difference? Take the example of online forums. You can create an alias, or pseudonym, and post your views using this assumed name. Although this technique can mask your ID to a degree, your long-term posting content and patterns reveal clues about you, and careful research could uncover your real identity. Likewise, because the blockchain is open and accessible, transaction analysis is a powerful technique that can be used to link real world identities with Bitcoin addresses. Sarah Meiklejohn, a computer science researcher from UCSD, has shown that examining the transaction patterns in the blockchain can often link Bitcoin addresses with those who control (or own) them [2]. Ok, let’s say you’re a criminal and still willing to leave indelible traces of your activities in the Bitcoin blockchain, hoping you won’t be investigated— ever. Ultimately, like everyone else, you’ll need to convert to local fiat currency which will require the use of a Bitcoin exchange. These gateways between digital currency and fiat are highly regulated and comply with anti- money laundering (AML) and know-your-customer (KYC) laws. A crook won’t be able to cash-in bitcoins without providing identity to a bank and the exchange. Large or suspicious cash withdrawals will likely be flagged or even frozen until approved by a bank.

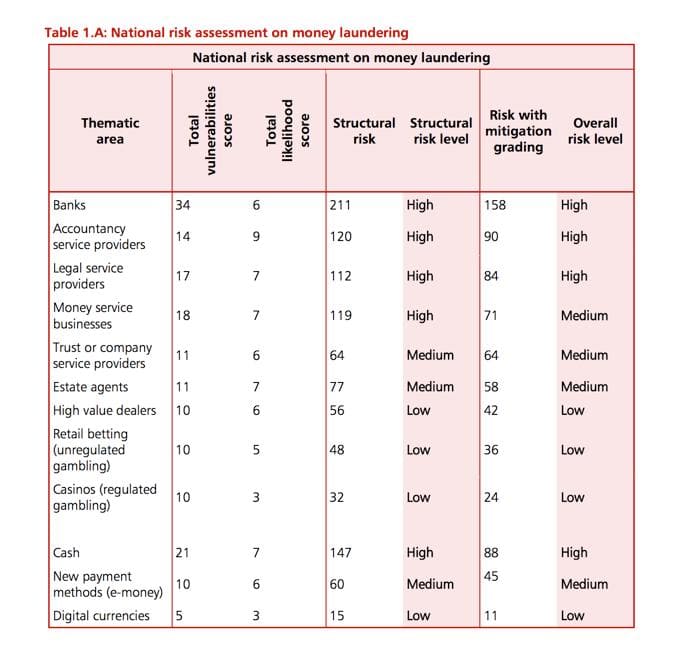

Do you still think Bitcoin is a paradise for criminals? This past October, the UK released a national risk assessment for money laundering and terrorist financing faced by their region, notably one of most important money centers in the world. The table included from the recent UK study clearly shows that banks and cash pose the highest risk, and digital currencies such as Bitcoin the lowest risk by far [3]. Now imagine a world where every cash transaction that ever happens were recorded in the cloud and accessible for forensic examination, don’t you think this would give money launderers and criminals pause?

References

- Bloomberg, J. (2016, January 18). Forbes / Tech. Something Rotten In The State Of Bitcoin. Retrieved from http://www.forbes.com/sites/jasonbloomberg/2016/01/18/ something-rotten-in-the-state-of-bitcoin/#2715e4857a0b20c1cb444650

- Meiklejohn, S. et al. (2013, December). A Fistful of Bitcoins, Characterizing payments Among Men with No Names. Retrieved from https://cseweb.ucsd.edu/ ~smeiklejohn/files/login13.pdf

- HM Treasury. (2015, October). UK national risk assessment of money laundering and terrorist financing. Retrieved from https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/468210/UK_NRA_October_2015_final_web.pdf